Content

- Accounting Consultant Salary by State

- Taxes on consulting fees don’t have to be hard

- Can consulting fees be booked as deferred charges until benefit is received?

- What do you charge for consulting when starting out?

- QuickBooks Services

- What Is Digital Consulting, and How Do You Start?

- Summary of Our Key Findings on Consulting Fees

Just take a look at Laura Belgray’s now retired 1-on-1 copywriting consulting rate pages. She charges $1450 for a single hour of her time and $10,000 for an entire day! If your consulting services can help clients make bank, they should pay you more.

Send online invoices from anywhere to get paid fast. Find out how much it costs to use a payroll company and how it… Compensation data tools, salary structures, surveys and benchmarks. Monitor inventory of stock accounts, prepare status reports for all fixed assets. Review the job openings, similar jobs, level of education, and experience requirements for the Accounting Consultant job to confirm that it is the job you are seeking. Let’s take a look at the different methods you can use to create your pricing structure.

Accounting Consultant Salary by State

She was welcoming and it was great meeting her. Definitely would recommend visiting this place for ITIN and looking forward for similar experience for Tax filing with her help. Vinita is extremely efficient, and very accommodating.

For example, Indeed reports that accounting consultingants in Houston, Texas earn an average of $71,176 per year compared to $55,232 in Los Angeles, CA. So, how much do accountants charge per hour on average?

Taxes on consulting fees don’t have to be hard

While it can be tricky territory, learning how to calculate and pay self-employment taxes for your consulting work is a small price to pay to have the freedom of being your own boss. Vini and Jack do a fantastic job of communicating and having a sense of urgency for you as a client. This is greatly appreciated as a business owner.

Although we’re here to bring you some quick fee-setting tips, the process itself probably won’t be lightning fast. Go ahead and take your time setting your prices to ensure you bill clients fairly.

Can consulting fees be booked as deferred charges until benefit is received?

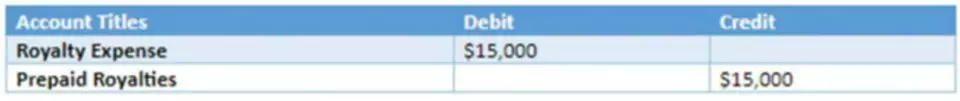

If you’re a business consultant who wants to make $10,000 a day and you find a client who is willing to pay $10,000 a day, you’ve just determined the “value” of your service. They also spend a huge portion of their time looking for consulting clients. Company ABC hires a consultant to provide recommendations regarding to the new accounting standard. It is not the regular expense that company has to spend to acquire the contestant to provide the best solution.

- The average median hourly pay for accountants is $37.14 per hour.

- Just to be safe, let’s remove 2 days out of 5.

- Make this clear in your consulting agreement.

- How many of following accounts would appear in a year-end balance sheet?

With every value-based price, you want to create a 3-10x ROI for your client. Remember, you are charging based on the ROI you will create. For example, helping your client generate 3 clients per month will generate $18K in monthly recurring revenue. If you are a more experienced consultant with 2-5+ years of experience, we recommend switching to a higher-leverage pricing model like value-based pricing. Eventually, you’ll get to the point where charging by the hour is no longer the best method for you or your clients.

What do you charge for consulting when starting out?

Below we’ll review what influences consultancy fees, how to determine yours, and how to take payments once you’ve started working with clients. Ensure your tax consultant understands your business type and industry. For example, if you own a restaurant, you have specific restaurant accounting issues and must deal with rules regarding tips and wages. If you own a construction company, you must deal with subcontracting issues. Remember to take your time when choosing a tax consultant and only hire someone you’re comfortable with. If you need help with taxes for a specialized business, find tax consultants with a background or special interest in your line of work. Assign a unique number to every invoice you create.

- Unearned revenues; Prepaid rent; Revenues.

- Extremely reliable, extremely knowledgeable, and willing to work with their clients.

- Average fee to file individual taxes with no itemized deductions is $176.

- At the very last minute of my tax filing and ITIN generation for…

- It’s all about their perceived value of your services.

- Find a tax consultant who has worked with other businesses like yours and knows about the ins and outs of your industry.

I would definitely https://www.bookstime.com/ Vini/ Jain Consulting for tax services. A very smooth process and guidance for my requirements right… I’ve been taking tax services from Jain Consulting for the past 2 years and it’s always a good experience.